It was inevitable that tax policy would be one of the main areas of contention in this general election. Frankly it always is because, along with the cost of living, tax is where reality hits you in the pocket.

The current government is hardly starting from a position of strength having overseen a series of tax measures over the last 14 years that have left us with overall taxation at a post war high relative to GDP.

Ministers can point to exceptional events such as the pandemic and Ukraine, but the fact remains that a combination of over target inflation and frozen personal allowances in particular has left us with a situation that is both difficult and set to worsen.

We now have a new battle opening up with the Conservatives challenging Labour to clarify their intentions on taxing property, specifically on the family home.

It is important to keep in mind that over the course of a Parliament, ministers and policies can and do change. After all, we have had three prime ministers in just the last five years.

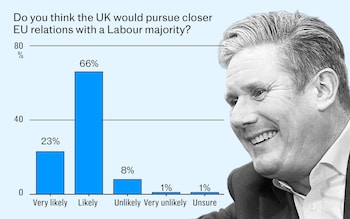

Sir Keir Starmer and shadow chancellor Rachel Reeves may set out policies in public statements on Sunday which they genuinely intend to follow, but find themselves blown off course by subsequent events. Every political party is by nature a coalition containing a range of views. Therefore, there is the threat of the Labour left increasing their influence.

We have recently witnessed this happening with infighting between the various wings of the Conservative party. So, it is worth considering what could happen following a Labour election victory, particularly if this happens.

I do not intend this to be project fear, simply a reflection of the reality of the tight financial position the county is in and what a new government will be left to deal with.

The Conservatives have pledged a “family home tax guarantee”, and not to raise capital gains tax (CGT), stamp duty or the number of council tax bands.

However, when challenged during an interview on Sky News, Labour shadow minister John Healey said Labour’s plans “do not require us to start looking at raising taxes across the board”, but refused to rule out rises on specific property taxes.

This is classic wording to leave options open. Last August when Ms Reeves said that the Labour party had changed course and would not now introduce a mansion tax on expensive properties, nor raise capital gains tax, it was criticised as a “shameful move” by the Labour left wing.

Capital gains tax

Capital gains tax relief on the main home is estimated to be worth over £31bn a year. It is regarded by the vast majority of home owners as a basic right which allows someone to move home without a capital gains tax impediment.

However, Labour have made it clear that they want to focus their help on “ordinary working people” many of whom have not yet managed to climb on the property ladder.

I am not suggesting that the exemption could be removed, but it could be capped such that additional revenue is raised on the more expensive properties.

The problem is how to deal fairly with gains made over many years and how to raise tax from those property rich but cash poor.

Stamp duty

When I bought my home in 1988, the stamp duty rate was 1pc. In England and Northern Ireland, you now pay at 5pc between £250,000 and £925,000, 10pc above that up to £1.5m and 12pc thereafter. It would be easy for these rates to be increased, particularly at the higher end.

The problem with this, of course, is that people in large houses may simply stay put and make it even harder for those with growing families to find suitable properties to buy.

I hope that the “bedroom tax” does not start appearing on the Labour agenda again as an encouragement for the elderly to downsize.

Council tax

With councils up and down the country struggling financially, there is bound to be pressure for council tax to be raised and possibly for a higher band at the top end.

Some in Labour have argued that the example of Wales should be followed where revaluations are more frequent and a top band applies. Wales last had a country wide property revaluation in 2003 and had planned a second revaluation this year although this has been delayed until 2028.

Alternatively, some have argued for council tax to be replaced with a broader based land tax. Revaluations are cumbersome and expensive but the new government could allow tax rates to be raised, particularly for higher value properties.

Ms Reeves has previously floated the idea of replacing council tax with a property tax. Writing in her 2018 pamphlet “The Everyday Economy”, she said this would “place the burden on landlords and not tenants”, and potentially “remove the attraction of using empty houses as investments rather than homes”.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.