European stock markets extended their losses for the third consecutive trading day amid ongoing election turmoil, as far-right parties gained unexpected power. The French markets were hit hardest after Prime Minister Emmanuel Macron called for a legislative election in response to significant vote gains by the far-right National Rally (NR) party.

French stock market extends a three-day losing streak

The selloff deepened on Tuesday, with the benchmark index, the CAC 40, slipping 1.33%, contributing to a total loss of 3.2% over the past three trading days. French banking stocks experienced sharp declines as investors grew concerned about France's public finances, particularly its ability to repay its debts. Shares of France's largest bank, BNP Paribas SA, slumped 9%, while Societe Generale Group's stocks shed 12% over the last two trading days.

Beyond the banking sector, French renewable stocks also faced intense selloffs. Engie and Voltalia have tumbled by 8.3% and 87.6% respectively in the past three trading days. The Marine Le Pen-led NR party is particularly opposed to the European Union's green transition plans. A potential takeover of leadership by the far-right party in France could disrupt existing wind farms and highway projects, Pierre-Alexandre Ramondenc, a utilities and renewables analyst at Alphavalue, told Reuters.

French government bonds continue slumping amid Moody's warning

Investors also continued dumping French government bonds after the rating agency Moody's warned of a "credit negative" outlook for the country due to political uncertainties. The 10-year French government bond yield spiked 35 basis points before pulling back on Wednesday, reaching its highest level since November 2023. Bond yields move inversely to bond prices.

Meanwhile, government bonds of other major EU economies, including Germany, Spain, and Italy have all surged during the election period. However, the selloff took a breather on Tuesday, which led to widened yield spreads between French notes and its EU peers. Typically seen as a safe-haven asset in the region, German bond yields dropped, while the French yields continued rising, making the 10-year yield gap between the two sovereign bonds the widest seen in seven months.

Government bonds and credit ratings

Government bonds are debt securities issued by a government to support government spending and obligations. They are often considered low-risk investments because they are backed by the credit of the issuing government. Government bond yield is the return an investor can expect to earn if the bond is held to maturity. Credit ratings are assessments of the creditworthiness of a borrower.

When a government bond has a high credit rating, it attracts more investors seeking safety, especially during times of economic uncertainty. This increased demand raises the bond's price and reduces its yield. Conversely, a downgrade in a government's credit rating signals increased risk, reducing demand for its bonds. The price of the bonds falls, and yields rise as the government must offer more attractive returns to lure investors.

The FOMC meeting may stabilise the EU markets

Investors may shift their focus to the upcoming Federal Reserve's (Fed) rate decision on Wednesday, which could overshadow the impact of the EU elections on the EU markets. The Fed is expected to offer a dovish stance, potentially providing a dip-buying opportunity in various assets, including stocks, bonds, and currencies, particularly in France.

"EURUSD might stabilise amid upcoming US inflation data and the Fed meeting," noted Charu Chanana, Head of FX Strategy at Saxo Bank.

Andrew Balls, chief investment officer at PIMCO, told Reuters that "the widening of French spreads could present a buying opportunity before too long", as Le Pen seems to be less Eurosceptic than she was in 2017.

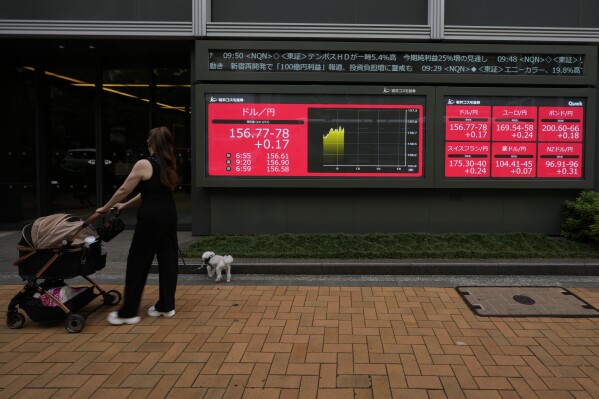

The euro continued weakening against all the other G-10 peers for the fourth consecutive trading day on the political jitters. At 3:15 am Wednesday, European Central Time, the single currency fell against the US dollar to 1.0735, the lowest in one month. And the euro softened against the British Pound to 0.8430, the lowest seen in August 2022.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.