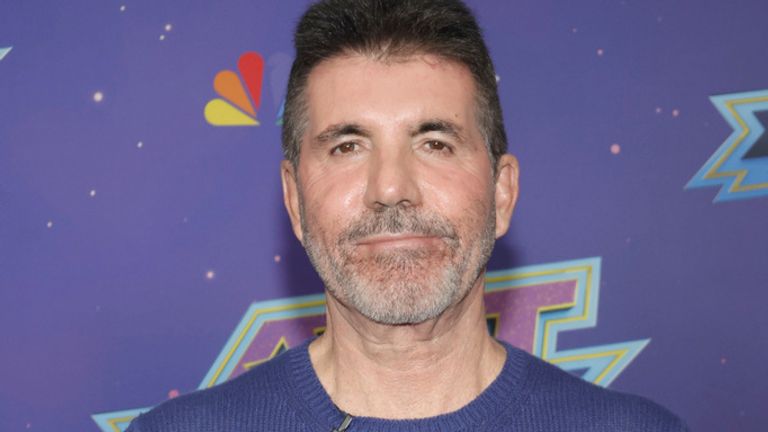

A music-streaming service whose shareholders include Simon Cowell, Kylie Minogue and Robbie Williams is racing to raise millions of pounds within weeks.

Sky News has learnt that ROXi has appointed Begbies Traynor Group, the professional services firm, to work alongside Rockefeller Capital Management on the hunt for new capital.

Founded in 2014, ROXi described itself as the world's first 'made-for-television' service, allowing viewers to stream millions of songs and download hundreds of thousands of karaoke tracks.

It has drawn a star-studded list of investors, which also includes Alesha Dixon and U2 bassist Adam Clayton.

Three of the world's biggest record labels - Sony Music, Universal Music Group and Warner Music - are also among ROXi's shareholders.

Prominent figures from the business world including former Saracens owner Nigel Wray, the former McLaren boss Sir Ron Dennis and private equity tycoon Guy Hands have backed the company for some time.

In total, ROXi, which has a distribution deal in the UK with Sky, the immediate parent of Sky News, has raised £40m from its cast of investors.

It has repeatedly hinted that a stock market flotation is its long-term ambition.

It is said to have been in protracted discussions for months with a US-based broadcaster - thought to be Sinclair - and an American media company, about the sale of an equity stake, although a deal has yet to be signed.

Earlier this year, ROXi announced a partnership with Sinclair to launch a trio of interactive music channels on compatible devices.

"Our partnership with Sinclair will revolutionize what broadcast TV means for millions of households across the US," ROXi chief executive Rob Lewis said in January.

"Viewers will get instant access to TV music channels that feature the interactivity and capabilities of a music app, without having to download or launch an app."

In recent weeks, Begbies Traynor is understood to have approached prospective investors, with a deadline for attracting new funding said to have been set for early next month.

A person close to the company said securing capital from the US was vital because it was required to roll out the FastScreen technology enabling audiences to watch traditional linear TV channels in the same way they access modern streaming services.

This weekend, it was unclear whether an equity investment from Sinclair or another American broadcaster would proceed or on what terms.

In response to an enquiry from Sky News, a ROXi spokesman said: "In order to enable a launch into the US broadcast market in 2024, the board are progressing several active funding solutions, including proposals for funding from existing major shareholders, management and a number of US broadcasters and are confident of making a positive announcement shortly."

Mr Lewis has said that ROXi is not positioned as a rival to music-streaming apps such as Apple Music or Spotify, but as a way for customers to enjoy visual music experiences on the household's biggest screen - their living room TV.

"ROXi has one of the most stellar investor lists of any company in the music industry - it deserves to succeed," one investor said this weekend.

An insider added that a successful outcome to its hunt for new capital was expected to trigger the appointment of a new chairman to replace Rupert Howell, the former ITV executive who recently stepped down from the role.

It was unclear what ROXi's next steps would be if its search for funding did not conclude successfully in the coming weeks.

Financial results for last year are not yet available, according to the company's spokesman.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.