Shares in ASOS, the online fashion retailer, have risen sharply after it revealed a sell-off in its Topshop brand and guided that annual profits would come in at the top end of forecasts.

The company, which has been struggling in the face of tough competition, said it would offload a 75% stake in the Topshop operations to Heartland - the holding company of Danish fashion store billionaire Anders Holch Povlsen.

ASOS said it would retain a 25% interest under a new joint venture with Heartland, which is its largest shareholder, and expected net proceeds of about £118m from the deal.

Money latest: Fake voucher trend sees supermarket call in police

They would be used to bolster its balance sheet, the company added.

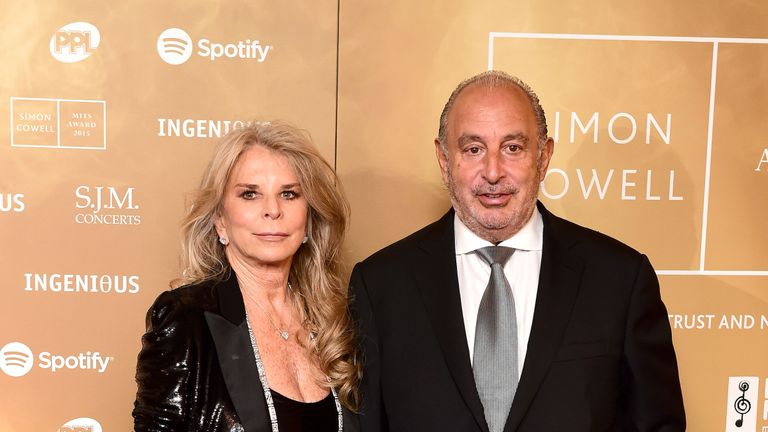

It had bought the Topshop brand in 2021 from the administrators of Sir Philip Green's collapsed Arcadia group, along with its Topman, Miss Selfridge and HIIT brands.

ASOS paid £265m at the time.

But times have been tough for ASOS since the end of the pandemic as it has grappled financial losses amid supply chain woes and stiffer competition in the crowded online fast fashion space, with the likes of Temu and Shein putting pressure on margins.

Shares were up by 18% in the wake of the company's announcement, which also updated on guidance for the financial year.

ASOS said it expected sales to be slightly below its previous forecast but said that adjusted core profit was now expected to come in at the top end of market expectations.

Analysts largely saw the Topman sale as a positive for ASOS.

Read more from Sky News:

Second-class letter deliveries face curbs

Water company bosses face prison under sewage spill crackdown

New UK car sales fall as Europe's manufacturers feel strain from weak demand

But Jelena Sokolova, senior equity analyst at Morningstar, said of the move: "ASOS's decision to sell a 75% stake in its Topshop and Topman brands for £135m to Heartland A/S indicates a capital-destructive move, raising questions about the quality of previous capital allocations.

"However, the sale can be seen as a strategic step to enhance balance sheet quality. With net debt at £348.8 million as of March 2024, this move should improve ASOS's financial standing, providing £118 million in cash and reducing borrowings by £13 million.

"This positions ASOS to better weather the challenges posed by a post-COVID downturn in the online apparel industry", she added.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.