Much has been made of the Murdoch succession saga as it appears to be nearing a conclusion.

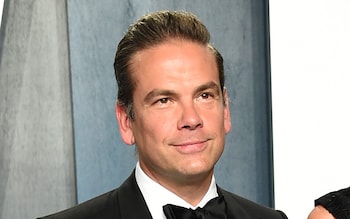

The future of one of the most powerful media dynasties on the planet is expected to be decided in the coming months in a courthouse in downtown Reno, Nevada, when a judge will decide whether Rupert can effectively hand control of his business interests to son Lachlan against the wishes of his other children James, Elisabeth and Prudence.

The court battle has served as a reminder that the tycoon is used to getting his own way as his empire has consistently grown to include hugely influential news outlets such as Fox News, the New York Post and the Wall Street Journal in America, along with The Sun and The Times in the UK.

Yet there have been setbacks, including in the UK. A doomed quest by REA, where Murdoch’s News Corporation is the majority shareholder, to buy British equivalent Rightmove, is the third time the tycoon has tried and failed to take out a FTSE 100 company, after being outbid for broadcaster Sky in 2018.

The £6.2bn bid for Rightmove is partly driven by Lachlan’s desire to further diversify the family’s business interests. With the might of News Corp behind it, perhaps REA thought Rightmove might be intimidated into quickly rolling over.

Yet the board, led by its chairman Andrew Fisher, has bravely stood its ground – something that should be wholeheartedly welcomed as a much-needed break from Britain’s bizarre and long-standing habit of selling its brightest and best companies to the highest bidder.

Hopefully, Rightmove’s resistance can act as a catalyst for reversing a trend that is far less pronounced in other major economies.

After a month-long frenzy – during which REA saw a total of four offers rejected – the company was forced to concede a humiliating defeat, withdrawing its interest just hours before a “put-up-or-shut-up” deadline expired at 5pm on Monday under UK takeover rules.

The conviction of the Rightmove board is understandable and to be applauded. While REA was keen to highlight that its final 780p cash and stock bid represented a 41pc improvement to Rightmove’s share price before REA came knocking, the Australian organisation was less forthcoming about the fact that Rightmove shares were trading close to 800p at the beginning of 2022.

And in trumpeting the strength of its own technology, the implication was that Rightmove’s might be weak. Yet with a near-monopolistic market share of more than 80pc and 1m visitors a day to its website that manifestly cannot be the case.

The idea that this country benefits by allowing the best of UK plc to be creamed off by overseas buyers, or become their mere subsidiaries, is absurd.

There are few examples of UK companies thriving as part of a sprawling multinational. More often than not, the very opposite is true. The fate of Boots under the control of Walgreens springs to mind. Ditto, Asda under Walmart. Both became unloved and somewhat forgotten corners of global corporations.

Boots’s tired stores are in dire need of investment and it has long lagged behind its competitors when it comes to the embrace of the internet.

The list of challenges facing Asda are partly a direct result of its debt-fuelled takeover at the hands of the Issa brothers and private equity firm TDR Capital. But it’s not as if a decade under the ownership of Walmart prior to that, heralded many benefits. Meanwhile, progress continues to be impeded by huge multi-million fees Asda is forced to pay Walmart for use of its IT systems.

Meanwhile, the sale of chip designer Arm – arguably the most successful technology company Britain has ever produced – in 2016 to Japan’s SoftBank must rank as one of the greatest acts of self-harm ever committed. Rishi Sunak’s failure to convince Arm to choose London over New York to relist its shares when Softbank chose to exit last year, has only served to compound the error – with a market cap of $153bn (£114bn) Arm has tripled in value since the snub.

Meanwhile, a national predilection for selling the crown jewels of commerce and industry is almost a uniquely British affair, driven by a long line of governments who have somehow allowed themselves to be fooled into believing that this represents genuine foreign investment when of course it is nothing of the sort.

As culpable are the stewards of those companies that cave in to takeover bids at the first opportunity without any attempt to make the case for remaining independent. Why do so few management teams have the confidence to go it alone? Selling out is much easier than standing behind a strategy that has yet to pay off, or worse may be faltering. Under-pressure boards are too quick to point to their fiduciary duties to put any serious proposal to a shareholder vote.

Yet, often the so-called premium being waved in front of investors’ noses is flattered by a share price languishing close to, or at, all-time lows. The weakness of the pound is often conveniently overlooked too.

But what about a responsibility to consider the national interest, or indeed the bigger picture? Often there is greater value to be created in the long-term by maintaining the status quo.

Take Greggs, the humble purveyor of sausage rolls and other baked delights. No doubt it has had numerous suitors, but instead of leaping into the arms of an admirer it has stuck to its guns. As a result investors have been rewarded with a 30-fold share price increase over the last three decades.

High street bellwether Next, fantasy games maker Games Workshop, and heavy machinery supplier Ashtead have delivered similarly eye-popping returns by resisting the temptation of the quick sugar-rush that comes from a takeover.

With similar nurturing, there’s no reason to think that in another 30 years, the same won’t be said of Rightmove.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.