Campaigners have hailed a "momentous day" as the government announced an independent review into a controversial tax policy that has been linked to 10 suicides.

Chancellor Rachel Reeves' budget has included a promise to commission a fresh analysis of the impact of the Loan Charge.

Politics Live: Experts taken aback by Labour's 'massive' tax plans

The legislation was announced in 2016 with the aim of recovering money from tens of thousands of freelancers and agency workers who were paid their salaries in tax-free loans.

This was widely promoted as HMRC compliant by lawyers and tax advisers in the 1990s and early 2000s, but that was not the case.

It led to the tax office retrospectively pursuing workers for bills they could not afford, years after their involvement in the schemes.

Those subject to the charge face paying back all the tax avoided in one go, with bills for some running into six figures.

A debate in parliament earlier this year likened the Loan Charge to the next Post Office Horizon scandal, with the harsh tax crackdown linked to 10 suicides, family breakdowns and bankruptcies.

Critics say people caught up in the saga are victims of mis-selling and HMRC should have gone after the recruiters who actively encouraged workers to be paid in this way.

The commitment in today's budget follows through on a promise made by the chancellor ahead of the election.

In January, Ms Reeves told LBC Radio that HMRC was chasing people for money they did not have and a more proportionate solution must be found.

"We are talking about ordinary people on ordinary wages but were contractors and were encouraged by their accountants to participate in these schemes," she said.

A review was previously conducted by Lord Morse in 2019, but MPs from across the political spectrum said its conclusion was "flawed" while a Sky News investigation found the tax office was effectively ignoring its findings in any case.

Those calling for change say that as well as being unfair, the Loan Charge is a failure, with around 40,000 cases not settled.

News of the fresh review comes after Treasury minister James Murray met with Loan Charge victims shortly after the election.

It was announced not in the budget speech but in a follow up document which said: "The government will commission an independent review of the Loan Charge to help bring the matter to a close for those affected whilst ensuring fairness for all taxpayers.

"Further details about the review will be set out by the Exchequer Secretary in due course."

Read More:

Pensioner with cancer bankrupt after tax 'dupe'

HMRC accused of 'airbrushing' Loan Charge scandal amid calls for inquiry

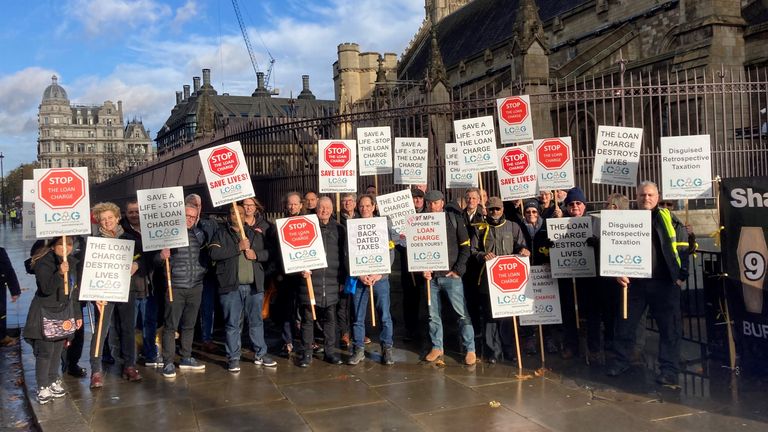

The Loan Charge Action Group hailed the announcement as a "momentous day" but said there was a "long way to go before justice is found" - and caused for a pause in HMRC pursuing people while the review takes place.

Steve Packham, a spokesperson for the group, told Sky News the fresh review must be "genuinely independent" and "look at the whole issue", including the role of Gordon Brown-era IR35 laws that cracked down on contractors working through limited companies, pushing them towards loan schemes that promised to keep their tax affairs in order.

Mr Packham said: "It is hugely positive that the chancellor, Rachel Reeves, has made good on her promise to commission a fresh, independent, review of the Loan Charge.

"We thank her and James Murray for this and for actually listening to those whose lives have and are being ruined by the Loan Charge scandal."

He added: "This fresh review must be genuinely independent and this time must look at the whole issue, the role of IR35 legislation, the entire contractor supply chain and the misconduct and failures of HMRC.

"There must now be a pause in related HMRC activity, to allow for the review to be established and to then properly examine the whole scandal, leading to a fair and final resolution for the thousands of families affected."

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.